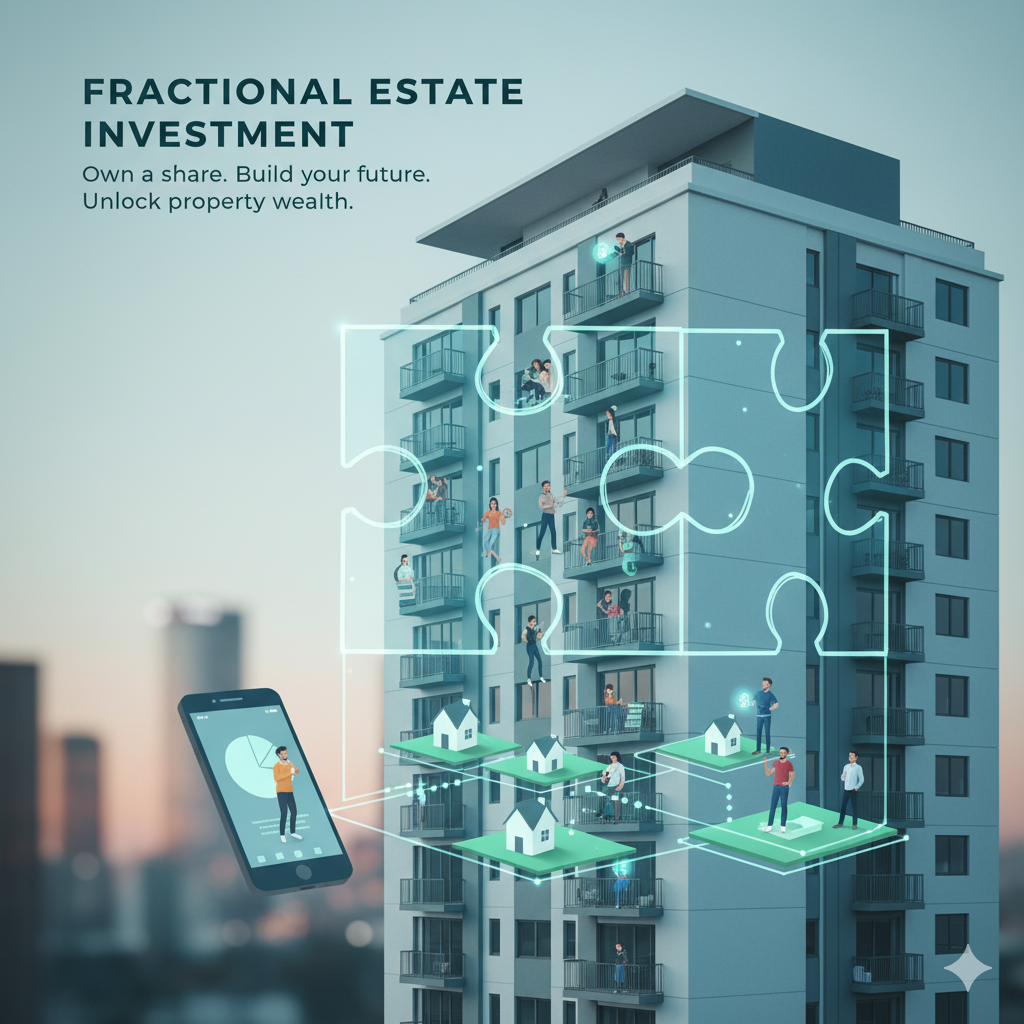

Fractional real estate investment is transforming the way people engage with the property market, offering a fresh perspective on ownership and investment opportunities. As traditional barriers to real estate investment often deter individuals from participating, fractional ownership breaks down these obstacles. By allowing multiple investors to share the costs and benefits of a property, fractional investing makes real estate accessible to a broader audience, empowering everyone to participate in wealth-building through property.

In this blog post, we will explore the myriad benefits of fractional real estate investing for all investors, from beginners to seasoned veterans. We’ll discuss how fractional ownership democratizes access to lucrative real estate opportunities and maximizes potential returns for individuals regardless of their financial background. Join us as we delve into the advantages of this innovative investment approach and discover how it can create pathways to financial freedom and growth for everyone.

Discover the advantages of fractional real estate investing for everyone

Fractional real estate investing opens up a world of opportunities for a diverse range of investors, making real estate accessible to individuals who previously faced financial barriers. By allowing multiple investors to co-own a property, this model lowers the financial commitment typically associated with real estate ownership. As a result, even those with limited capital can participate in the market, diversifying their investment portfolios and reducing risk exposure. This shift enables everyday individuals to tap into lucrative real estate markets and gain potential returns that were once reserved for affluent investors.

Moreover, fractional ownership simplifies the management and maintenance of properties. Investors share responsibilities, from property upkeep to financial oversight, which eases the burden on individual owners. This collaborative approach not only fosters a sense of community among investors but also encourages more informed decision-making, as multiple perspectives contribute to property management. By embracing fractional real estate investing, everyone—from novice investors to seasoned professionals—can leverage the benefits of property ownership while optimizing their financial strategies.

Unlocking accessibility: How fractional ownership democratizes real estate

Fractional real estate investing breaks down the barriers that traditionally restrict access to real estate markets. In the past, only affluent individuals could afford to invest in high-value properties, leaving many potential investors sidelined. Now, fractional ownership allows people to purchase a share of a property without the hefty financial commitment that comes with buying a whole unit. This democratization of real estate means that individuals from diverse financial backgrounds can enter the market and start building wealth through property investments.

Moreover, fractional investing fosters a sense of community among investors. As people join together to pool funds for real estate ventures, they also share expertise and insights, creating a collaborative environment that benefits everyone involved. This shared knowledge not only enables investors to make informed decisions but also generates a support network that encourages ongoing learning and growth in real estate investment. By making real estate investment more accessible, fractional ownership paves the way for a broader spectrum of investors to engage with the market and enjoy the potential financial rewards.

Maximizing returns: Why fractional investment is beneficial for all investors

Fractional real estate investment offers a unique opportunity for investors to maximize their returns without requiring substantial capital upfront. By pooling resources with other investors, individuals can access a wider range of properties that might otherwise be out of reach. This collaborative approach enables investors to diversify their portfolios across different properties and markets, reducing the risks associated with investing in a single asset. Additionally, fractional ownership often comes with professional management, allowing investors to tap into expert knowledge and optimize their investments without having to manage properties themselves.

Moreover, fractional investment allows for lower entry barriers, providing both seasoned and novice investors the chance to participate in real estate markets. With smaller capital requirements, individuals can invest in multiple projects, increasing their potential returns over time. As the real estate market fluctuates, fractional ownership often proves resilient, offering regular income through rental yields and potential appreciation in property value. This structure helps investors of all levels to harness the profitability of real estate, making it an attractive avenue for building wealth and achieving financial goals.

Stay updated on our news and events! Sign up to receive our newsletter.

Thank you for signing up!

Something went wrong. Please try again later.